When returning from an international trip, for entry of goods acquired in a foreign country, it is mandatory that you consult the custom administration for the procedures of dispatch of baggage and those which are considered a relief from customs tariffs duties, through the site: www.dnre.gov.cv.

BAGGAGE DISPATCH

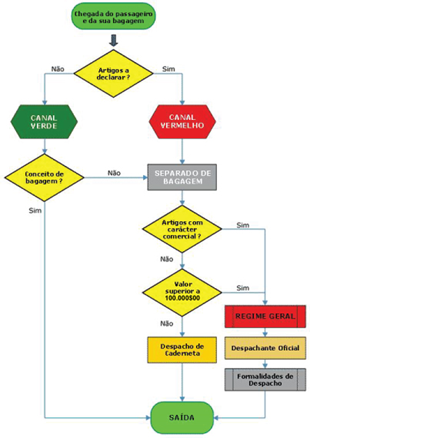

The diagram shows the steps for baggage clearance of a passenger arriving by air carriage

BAGGAGE - All personal goods authorized or not to accompany the passengers, always being exempt from any tax payment at the customs, if all requirements are met, both in quantity and nature.

According to the diagram, all articles that do not reveal a commercial character and of a value not superior to 15.000 (fifteen thousand escudos) benefit of the franchise regime.

FRANCHISE – Duty-free entry and of any other customs duties.

SELECTION FOR GREEN AND RED CHANNELS

GREEN CHANNEL – The import selected for the Green Channel is automatically clear of any verification. Waiving the need for a document exam, verification of goods and delivery of instruction documents for dispatch.

RED CHANNEL – In case of selection for the Red Channel, besides the documentary checking, there is a physical checking of goods (the merchandise will only be cleared after the document checking, the preliminary exam of the costs value and the verification of goods.

BAGGAGE SEPERATION – Merchandise with a commercial character subject to due taxes.

However, the articles that do not meet these requirements are under the Simplified Regime or General Regime, for more information consult the link Direção das Alfêndegas